Good Suggestions For Deciding On RSI Divergence Trading

Wiki Article

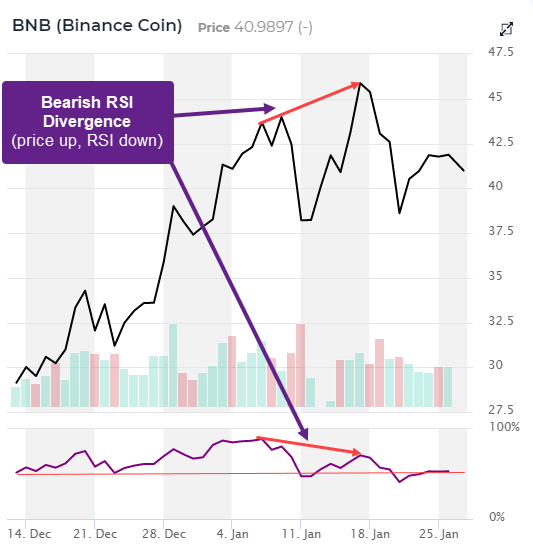

Let's begin by asking the obvious question and find out what RSI Divergence is and what trading indicators we can learn from it.|Okay, let's start by asking the obvious question. Let's explore what RSI Divergence means and what trading indicators it might give.|Let's start with the most obvious question. We'll explore the definition of RSI Divergence actually is and what trading insights we can derive from it.|Ok, let's start by asking the obvious question. We'll explore what RSI Divergence really is and the trading signals we can learn from it.|Okay, let's get started with the most obvious question. Now, let us examine the what RSI Divergence looks like and what information about trading can be gleaned from it.} If the price action on your chart and the RSI signal are not in alignment, a divergence could take place. In other words, when RSI and the price action are not in the sync, you will see a divergence on your chart. In a downtrend market the price will make a lower high, while the RSI indicator is able to make an upper low. Divergence occurs when the indicator is not in agreement with the price movement. When this happens, it is important to watch the market. The chart clearly shows bullish RSI divigence as well as bearish RSI divigence. As such, the price action reverted immediately following each RSI Divergence signal. Let's continue to the topic that is exciting. Read the top rated trading with divergence for website recommendations including automated trading platform, trading platform, bot for crypto trading, forex backtest software, RSI divergence cheat sheet, automated crypto trading, crypto trading backtesting, best crypto trading platform, trading platforms, automated crypto trading and more.

How Do You Analyze The Rsi Divergence

We utilize the RSI indicator as a way to detect trends that are reversing. However, it is crucial to recognize the most appropriate trend reverse.

How Do You Recognize Rsi Divergence In Forex Trading

Both Price Action and RSI indicators both formed higher highs prior to the beginning of the uptrend. This indicates that the trend is strong. But, at the trend's end it was evident that the price had higher highs while the RSI indicator had lower highs. This is a sign that something should be watched on this chart. This is the reason why we should pay close focus on the market. Both the indicator and the price action are out-of-synchrony, which signifies the presence of an RSI divergence. In this case this case, the RSI divergence indicates an upward trend. Take a look above at the chart to observe the changes that took place following the RSI diversification. The RSI divergence can be extremely accurate when it is utilized to determine trends that are reversing. The question now is how do you spot the trend reverse. Let's now talk about four strategies for trade entry which provide higher probability entry signals when paired with RSI divergence. Check out the top rated automated crypto trading for website advice including automated cryptocurrency trading, forex backtesting software free, trading with divergence, automated cryptocurrency trading, RSI divergence cheat sheet, cryptocurrency trading, trading with divergence, divergence trading, forex backtester, trading platform and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

There are two types of triangle chart patterns. One is the Ascending Triangle pattern that works in the downtrend as a reverse pattern. The pattern of the descending triangle works as an uptrend market pattern that reverses. The forex chart below shows the downward Triangle pattern. As in the previous example, the market was initially in an upward trend before the price fell. At the same time, RSI also signals the divergence. These signals can be a sign of the declines of this trend. This shows that the current uptrend is losing its momentum. Price has formed a triangular pattern that resembles a downwards spiral. This confirms that there is an upward reversal. It's now time to take action on the trade. This trade was made with the same breakout techniques similar to the one used in the previous trade. We'll now look at the third method of trading entry. We'll try to pair trend structure with RSI divergence. Let's look at how we can trade RSI diversion when the structure of the trend is changing. View the top rated best crypto trading platform for blog examples including automated forex trading, crypto trading bot, position sizing calculator, best forex trading platform, best crypto trading platform, crypto trading backtesting, automated trading, automated trading, backtesting strategies, best trading platform and more.

Tip #2 – Combining RSI Diversity with the Head &shoulders Pattern

RSI diversification is a useful tool for forex traders to recognize market reversals. If we mix RSI divergence together with other factors that can cause reversals, such as the Head and Shoulders pattern? This could increase the chance of making a trades. That's great isn't it? Let's examine how to timing trades with RSI divergence and the head-shoulders pattern. Related - How to Trade Head and Shoulders Patterns in Forex - A Reversal Trading strategy. Before thinking about trade entry, we must enjoy a positive market situation. If we are looking to witness any change in the trend, it is best to be in a good market. The chart is below. Check out the top rated best forex trading platform for blog advice including backtesting tool, RSI divergence, best crypto trading platform, automated crypto trading, automated trading software, automated crypto trading, forex backtesting software, RSI divergence, forex tester, crypto trading backtesting and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

The trend is our partner. Trends are our friends, so long as it's trending. However, we need to trade in the direction of its movement. This is what professionals instruct us. But the trend will not continue for ever. Somewhere it will revert. Let's look at the structure of the trend, RSI Divergence and how to identify reversals. As you are aware, the upward trend is making higher highs, while the downtrend is forming lower bottoms. So, with that in mind take a look at the chart below. If you take a look at the chart to the left, you will see that it is a downtrend. It shows a series of lows as well as higher highs. The next step is to examine the RSI Divergence (Red Line). Price action can create Lows and Highs, however the RSI can create higher lows. What do these numbers tell us? In spite of market-created lows, the RSI is doing exactly the opposite. This indicates that an ongoing downtrend is losing its momentum. It's time to plan for a potential reversal. Have a look at the top rated trading divergences for more tips including forex backtesting, trading platform, divergence trading, bot for crypto trading, stop loss, automated trading software, cryptocurrency trading, automated trading, trading divergences, trading platform and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

Double bottom or double top is a pattern of reversal that develops following an extended movement or after a trend. Double tops occur when the price is at an unbreakable level. broken. When it reaches that point it will then retrace little before returning to the level it was at. If the price moves back to the level once more, then you've got double top. Check out this double top. In the double top above you will notice that two tops formed following a powerful move. Notice how the second top was unable to rise above the previous top. This indicates a reversal. It is telling buyers that they struggle to keep climbing higher. Double bottoms employ the same techniques, but in a different method. We use breakout entry. In this instance, we execute selling the trade when price has risen below the trigger line. We recouped our profits after the price fell to below the trigger line. QUICK PROFIT. The double bottom is also covered by the same strategies for trading. Have a look at the following chart, which explains how you can trade RSI divergence using double bottom.

Keep in mind that this isn't the perfect all trading strategy. There isn't a one trading strategy that is perfect. In addition each trading strategy has losses. We can earn consistent profits through this strategy for trading however, we are able to implement a rigorous risk management method and a fast way to minimize our losses. This will enable us to reduce drawdowns, and open the door to huge upside possibilities.