New Tips For Choosing Forex Trading Bots

Wiki Article

What Factors Should You Be Aware Of About Rsi Divergence

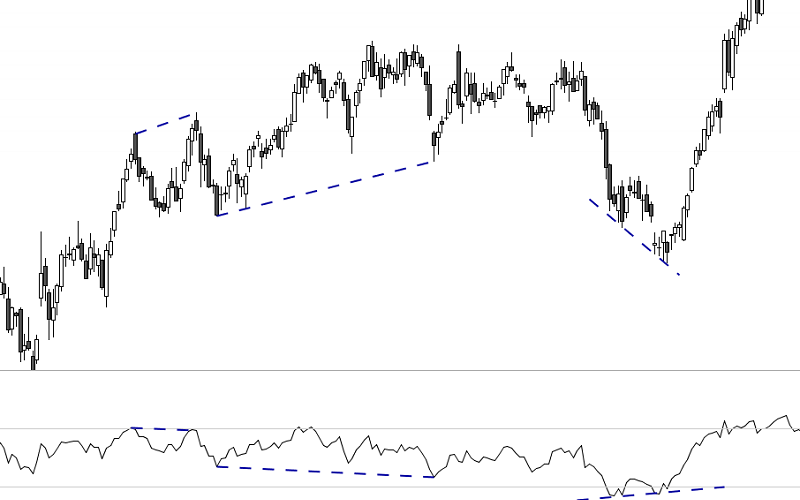

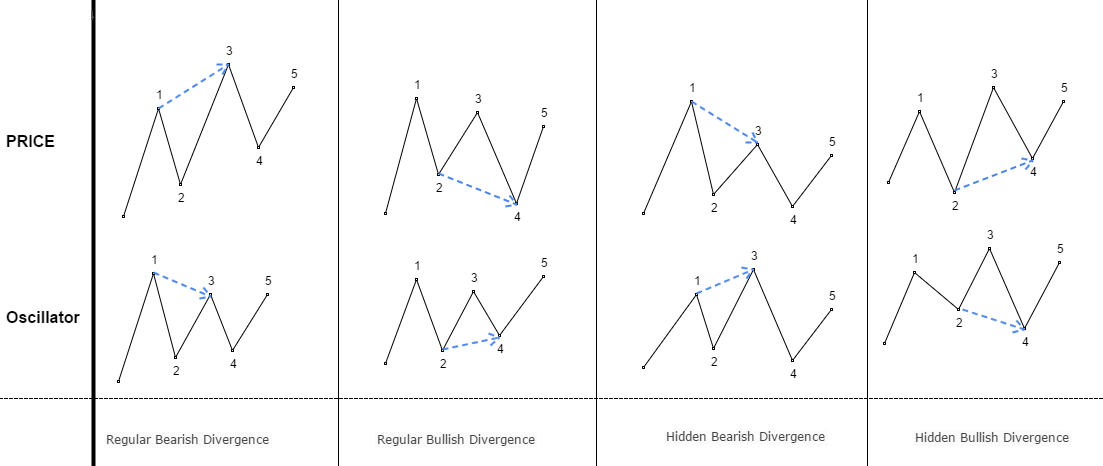

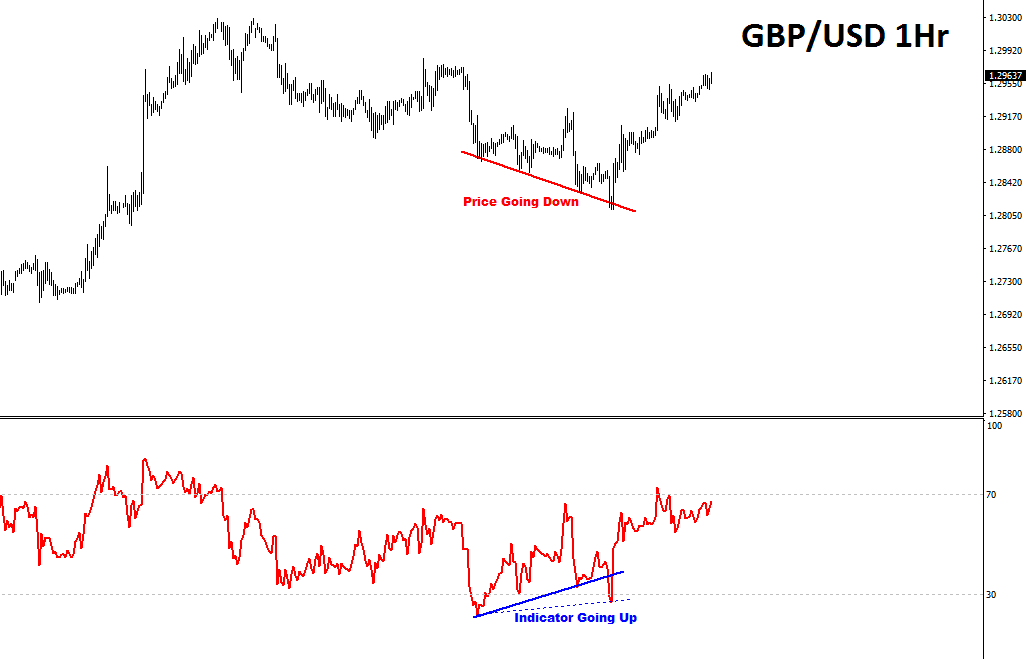

Definition: RSI Divergence is a technique for analyzing technical data that examines the direction in which the price of an asset to the direction of its relative strength index (RSI).Types: There are two kinds of RSI divergence, regular divergence and hidden divergence.

Signal Positive RSI diversification is considered a bullish signal. A negative RSI divergence is considered to be bearish.

Trend Reversal: RSI Divergence could signal the possibility of a trend reversal.

Confirmation RSI divergence is a method to confirm other methods of analysis.

Timeframe: RSI Divergence can be observed in various time frames in order to gain new insights.

Overbought/Oversold RSI Values above 70 indicate excessively high conditions. Values that are below 30 suggest that the market is oversold.

Interpretation: To understand RSI divergence correctly it is necessary to look at other technical and fundamental factors. Read the top rated stop loss for site tips including trading platform cryptocurrency, automated trading, software for automated trading, forex trading, automated forex trading, trading platform, automated crypto trading, crypto backtesting, position sizing calculator, software for automated trading and more.

What Is The Distinction Between Normal Divergence And Hidden Divergence?

Regular Divergence: A regular divergence is when the price of an asset is a higher high or lower low while the RSI is able to make a lower low or higher low. It could be a sign of a trend reversal. But, it's important to consider other technical and fundamental factors. Even though it's a weaker signal that regular divergence, it can still be indicative of a possible trend reverse.

Take into account technical aspects

Trend lines, support/resistance indicators and trend lines

Volume levels

Moving averages

Other indicators and oscillators

Think about these basic aspects:

Economic data

Information specific to businesses

Market mood and sentiment indicators

Global events and the impact of markets

It is essential to consider both technical and fundamental factors prior to making investment decisions based on RSI divergence signals. Have a look at the top automated trading for site tips including forex trading, backtesting strategies, forex backtesting, best trading platform, cryptocurrency trading bot, crypto trading, software for automated trading, automated trading bot, automated trading, backtesting tool and more.

What Are Back-Testing Trading Strategies To Trade Crypto

Backtesting trading strategies used in crypto trading is the process of simulated implementation of a strategy for trading using historical data to assess the potential profit. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy - Explain the strategy used to trade that includes entry and withdrawal rules including position size, as well as the rules for managing risk.

Simulator: Software is used to create a simulation of the trading strategy using historical data. This allows you to observe how the strategy would have been performing over time.

Metrics: Examine the performance of the strategy with metrics like profit, Sharpe ratio, drawdown and other measures that are relevant.

Optimization Change the parameters of your strategy and run the simulation once more to improve your strategy's performance.

Validation: Test the strategy's performance on outside-of-sample data to confirm its reliability and to avoid overfitting.

It is important to remember that past performance is not an indication of future results Results from backtesting are not to be regarded as an assurance of future returns. Also, live trading requires that you consider the effects of fluctuations in the market transactions fees, market volatility, and other aspects of the real world. Check out the top automated trading platform for more examples including crypto trading bot, trading divergences, backtesting trading strategies, automated trading software, crypto trading bot, trading divergences, backtesting platform, automated trading software, cryptocurrency trading bot, backtesting platform and more.

What Is The Best Way To Evaluate Forex Backtest Software For Trading With Divergence?

The following factors should be taken into consideration when evaluating forex backtesting software for trading with RSI divergence. Data Accuracy: Make sure that the program has access to quality historical data for the forex pairs being traded.

Flexibility: The software should permit the customization and testing different RSI trading strategies for divergence.

Metrics - The software should have a range of metrics to help evaluate the performance RSI divergence trading strategy such as the profitability of the strategy, drawdowns and risk/reward rates.

Speed: Software should be fast and efficient that allows users to rapidly back-test various strategies.

User-Friendliness: The program should be easy to use and understand, even for those without extensive technical analysis knowledge.

Cost: Take into account the cost of software, and then determine if you can afford the cost.

Support: You should have excellent customer service. This includes tutorials and technical assistance.

Integration: The program must integrate with other trading tools such as charting software or trading platforms.

It is recommended to test the program by using a demo account before you commit to paying for a subscription. This will help ensure that it is able to meet requirements and is simple to use. See the most popular automated trading software for blog info including backtesting, crypto trading bot, stop loss, crypto trading backtesting, trading divergences, trading divergences, trading platform, trading platform cryptocurrency, best crypto trading platform, divergence trading forex and more.

What Is The Way That Cryptocurrency Trading Robots Perform In Automated Trading Software?

A set of pre-defined rules is adhered to by the cryptocurrency trading robots which make trades on behalf of the user. The way they work is: Trading Strategy. The user chooses the strategy to trade. This includes entry and withdrawal rules including position sizing, risk and management.

Integration via APIs: Through APIs, trading bots can connect to cryptocurrency exchanges. They can get access to real-time market data and execute orders.

Algorithms: The bot uses algorithms in order to analyze market data and take decisions in accordance with a trading strategy.

Execution. The bot makes trades according to the trading strategy. It doesn't need manual intervention.

Monitoring: The robot continuously examines the market and makes adjustments to the strategy of trading if needed.

Automated trading in cryptocurrency is extremely beneficial. They are able to execute complicated routine trading strategies, without the requirement for human intervention. It also allows users to access market opportunities 24/7. It is crucial to realize that automated trading has inherent dangers. Software bugs, security issues, and the loss of control over the trading process are some of the risks that could be posed. Before you begin trading in real time, be sure to thoroughly test and evaluate the trading bot.